Best Option Trading Strategies| Intraday Option Strategy, earn $100 in a day

Many traders start trading in options without really understanding all the different strategies and due to lack of knowledge they loss their hard earn money. Here are 10 options strategies which are commonly used by Traders and available in different media platforms. These strategies help to reduce risk and make more money. But we are not discussing these strategies, we are discussing a very unique strategy for our readers :-

Common Strategies

- Bull Call Spread: Strategy for bullish traders, involves buying a call option and selling another with a higher strike. Reduces cost and risk.

- Bull Put Spread: Used for moderate price increase expectations, selling a put option and buying another with a lower strike. Benefits from theta decay.

- Bull Call Ratio Back-spread: Highly bullish strategy, involves selling calls and buying more with higher strikes. Biggest loss in desired direction.

- Synthetic Call : Combines stock ownership with protective put. Provides downside protection while holding shares.

- Bear Call Spread: Suited for bearish views, involves selling a call option and buying another with a higher strike. Yields net profit.

- Bear Put Spread: Anticipates slight price decline, buying put options and selling equal puts with a lower strike.

- Strip: Bullish on volatility but bearish on direction, buys at-the-money put and call options.

- Synthetic Put: Mimics Long-Put Option, involves short stock position and long call option. Offers downside protection with bearish sentiments.

Best Option Trading Strategy

Now we discussing our unique strategy which can also be used by beginner very easily. This is based on technical strategy, but no needs of a much experience of technical analysis. It is very simple, we will considered only 15 Min time frame candle on chart. this strategy can used for Nifty and Banknifty and other option stock, but we recommended to use on Nifty and Banknifty for better results.

IREDA Share Price Target 2025 Rs. 5000, IREDA Best Portfolio Stock 2024

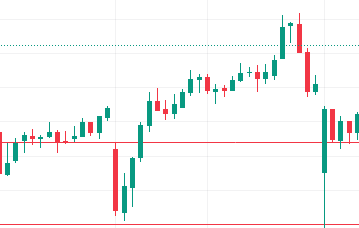

While market open we should wait to frame 02 candle of 15 Min time, will mark its 02 candle low and high and breakout either up or down side we will take a trade. Let we understand this strategy on chart on different date with example for better understanding :-

Example 01 :-

This chart is Nifty 22 March 2024, market open in negative and given 15 Min candle breakout with green candle, given good movement and profitable trade, this is very simple no needs to much calculation and observations of lots of indicators, this is simple to use. now lets see we more example.

Example 02 :-

This chart is Nifty 26 March 2024, market open negative and turn into green thereafter a full day no breakout of 15 min time frame, as per our strategy we should wait 02 candle of 15 min time frame and needs breakout either up or down side. But throughout the day not given breakout up or down, so no trading day.

There are very important rule for this strategy.

Rules for trading

- We should wait frame of 02 candle of 15 Min time.

- Entry only after breakout either upside or downside.

- Stop loss of last 15 min candle up or down and may be accordingly to risk reward, if candle is big size we should be go for calculated risk.

- Don’t over trade, if your are in profit book and exit, not sit whole day.

- This strategy if very good work for big gap up or gap down

How to identify fake breakout

- There may be fake breakout, what is idea to identify the fake breakout. we should mark up and down of 02 15 min candle on chart and turn time frame into 05 min candle, wait 05 Min candle closing on up or down side. Second method wait a pull back and breakout 15 Min candle in 05 min time frame, there are example for better under standing :-

- This chart of Nifty 28 March 2024, which shows clear breakout in five min time frame, we marked 02 candle of 15 Min time frame.

- This chart of Nifty 15 April 2024, shows fake breakout of 15 mints 02 candles. so it is better wait a pull back or breakout by a power candle as first chart example.

Accuracy of Strategy

- This strategy we have personnel back tested and given 80% results in intraday trading, which is best for ever, you will not be loss in end of the month by using this strategy, if trading with proper rules.

Special Attention

If first candle of 15 time frame is big size, market commonly goes full day in range, so don’t try this day to buy any option because this day is only for option seller. If wants to learn more about option trading earn regular profit, we will disclose more paid strategy on our website, don’t forget write us or comments and share to your friends.

1 thought on “Best Option Trading Strategies| Intraday Option Strategy, earn $100 in a day”

Comments are closed.